NCVET Course

e-Learning

e-Learning

Apply Now

Login

Apply Now

Login

BC/BF

Training for BC/BF

Schedule of BC/BF exam

Important Notice For BCBF Candidates

Apply (Members)

Apply (Non-Members)

Admit letter

Provisional Scorecard

Result

Apply for Duplicate Certificate

BCBF - GST Recovery

CSC-Exam Centre/Venue list

Guidelines and FAQ’s for BC/BF Certification Process

BC/BF प्रमाणन प्रक्रिया हेतु दिशा-निर्देश एवं अक्सर पूछे जाने वाले प्रश्नोत्तर

Membership

Exams (Members)

Exams (Non-Members)

Apply For Scribe

APPLY FOR CITAP CERTIFICATE

Apply for CISI examination (Level-II)

Apply for JAIIB/DB&F Contact Classes

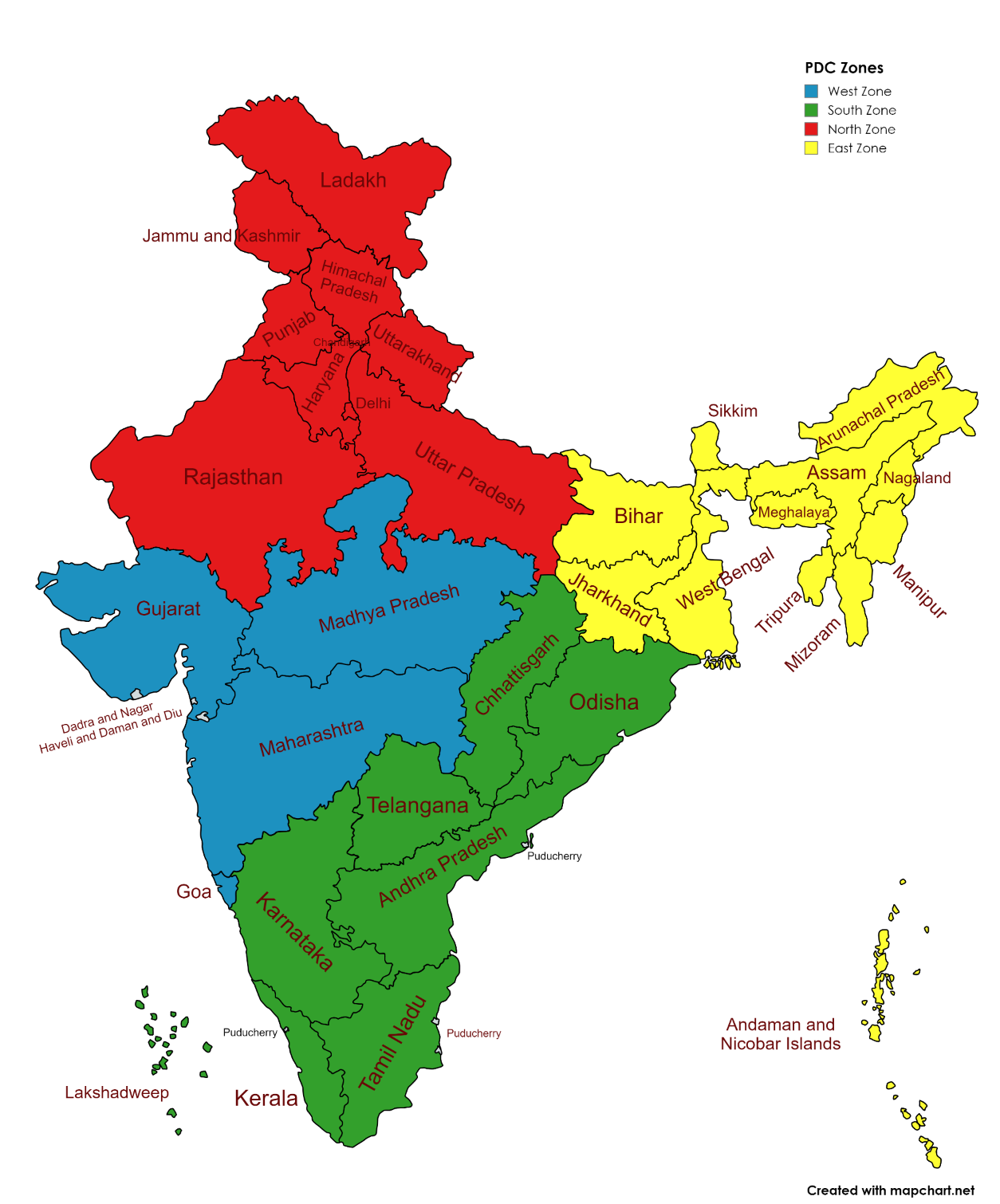

in Online Mode by IIBF, PDC-NZ Apply for JAIIB Professional Conversion

Route to Associate Chartered Banker Apply for Credit Transfer from DB&F to JAIIB Apply for Conversion from DB&F to JAIIB Apply for GARP-FRR Exam Apply for Professional Banker Qualification Apply for CFP-Fast Track Pathway Apply for Duplicate Certificate Download e-certificate DRA Examination Payment Transaction Query MOU College/Institute Mock Test

in Online Mode by IIBF, PDC-NZ Apply for JAIIB Professional Conversion

Route to Associate Chartered Banker Apply for Credit Transfer from DB&F to JAIIB Apply for Conversion from DB&F to JAIIB Apply for GARP-FRR Exam Apply for Professional Banker Qualification Apply for CFP-Fast Track Pathway Apply for Duplicate Certificate Download e-certificate DRA Examination Payment Transaction Query MOU College/Institute Mock Test

Notice

“Dear Candidates, registrations for all the exams are closed for maintenance activity from 12:00 noon to 1:00 pm. ”

Inconvenience is regretted.

Notice

Registration link will be activated shortly

Notice

“Dear Candidates, registrations for all the exams are closed for maintenance activity from 12:00 noon to 1:00 pm. ”

Inconvenience is regretted.

Coming Soon....!