As we navigate through the dynamic and fast changing landscape of the Indian banking sector, it becomes imperative that employees of the banks have to upgrade their knowledge and reskill themselves to face the challenges of VUCA world and contribute to their personal and organisational success.

The Indian Institute of Banking & Finance (IIBF) since its inception in 1928 is working towards capacity building of banks in India by providing a skill based courses/programmes for banking & finance professionals. JAIIB and CAIIB are considered as the flagship courses of IIBF for entry level bankers. These two certificate courses are designed to empower the bankers with the requisite job knowledge in various aspects of banking so that they can discharge their duties more effectively and efficiently.

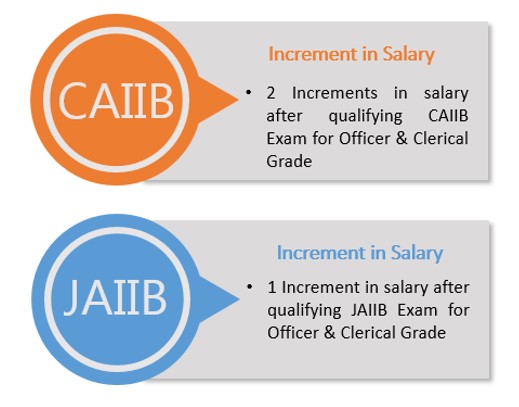

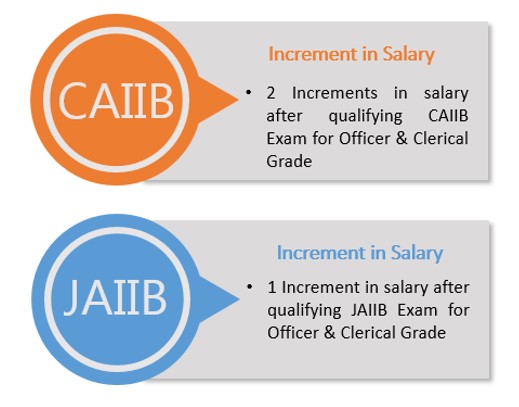

The flagship courses of the Institute are also recognised in the recent 12th Bipartite Settlement between Indian Banks’ Association & Bank employees. The Officers & Clerical employees of banks who are the signatories to the 12th Bipartite Settlement are eligible for 1 increment for passing JAIIB and 2 increments for passing CAIIB offered by IIBF.

Recognition of IIBF’s Flagship Courses in 12th Bipartite Settlement

As per the policy of the Institute, only those employees who are serving in banks are eligible to enrol for JAIIB & CAIIB examinations. In order to bridge the skill gap among the students aspiring to join banking & finance sector, Diploma in Banking & Finance (DB & F) is offered to students which is similar to JAIIB. When a candidate with DB & F qualification joins the bank he may convert DB & F Certificate into JAIIB through a simple application process and will be eligible to avail the benefits of JAIIB.

DB & F is recognised by IBA as one of the preferred courses for students aspiring to join BFSI Sector. It is observed that more than 70% of candidates who have passed DB & F examination have converted their certificates to JAIIB which indicates the high probability of employability for this course.

IIBF and IGNOU have entered into a Memorandum of Understanding (MoU) for offering the MBA Banking & Finance (MBF) Programme to the members of IIBF who have passed the JAIIB/CAIIB qualification under the revised syllabi of 2023. IGNOU shall give upto 20 credit transfer/exemption in MBF programme for maximum 5 courses out of 28 courses to the candidates who have successfully completed the corresponding subjects of JAIIB/CAIIB from IIBF within the maximum duration of MBF Programme.

FPSB India, the Indian subsidiary of Financial Planning Standards Board Ltd. the global standards setting body for the financial planning profession and owner of the international “Certified Financial Planner” (CFP) certification program, has entered into a strategic Memorandum of Understanding (MoU) with IIBF. Under this significant partnership, candidates who have successfully attained the CAIIB qualification from IIBF will be exempted from passing the first three modules of CFP Certification and become eligible to enrol in FPSB India’s Integrated Financial Planning module through the Fast Track Pathway. To qualify for this pathway, candidates must also have a valid three-year experience in banking and financial services. In addition to the above exemptions, FPSB India will also extend special discounts on the total course fees, examination fees, and other applicable fees to eligible CAIIB candidates who apply for the Certified Financial Planner (CFP) certification under the Fast Track pathway.

IIBF offers a gold level aspirational qualification, “Professional Banker” to meet the twin objectives of bridging the skill gaps and having a system of continuous professional development among the Banking fraternity. This Professional Banker qualification aims to create a pool of professionals in specialized and interlinked verticals to meet emerging challenges in banking domain. The candidates who have five years’ experience in financial service can select any track amongst the 5 specialised fields viz. Credit, Treasury, Accounting & Audit, Information Technology & International Banking to apply for Professional Banker qualification. As on date, more than 800 bankers have successfully awarded the Professional Banker qualification.

Apart from the flagship courses, IIBF also provides several other courses to upskill banking & finance professionals. Recently, the Institute has organised following programmes in banking & finance domain:

- IIBF’s Professional Development Centre – North Zone (PDC – NZ) organised a Management Development Program (MDP) for Nepal Institute of Banking.

- IIBF entered into MoU with FPSB for Certified Financial Planner certification program & organised a webinar on "Understanding CFP Certification by CAIIB members".

- IIBF-IFC joint Certificate course on Climate Risk and Sustainable Finance (Basic & Advanced levels).

- IIBF organised a Banking Conclave in collaboration with UNEP-FI and GIZ.

- Launched XIII Batch of Advanced Management Programme (AMP) in Banking & Finance 2024-25.

- Organised a Webinar on “Fintech, CBDC and Cryptocurrency: Financial Structural Transformation in India”.

- Organised a Treasury Conclave on “Role of Treasury in Making India a 7 Trillion Economy by 2030”.

The success of our efforts lies in enabling banking & finance professionals to acquire requisite knowledge and skills for their career development and also contribute towards creating an efficient ecosystem of banks, regulators and customers. We are confident that each member of the Institute will come out with flying colours towards achieving this goal.

Wish you all the best!

Biswa Ketan Das

e-Learning

e-Learning

Apply Now

Login

Apply Now

Login