Page Title

ABOUT IIBF

ISO 21001:2018 CERTIFIED

Established in 1928 as a Company under Section 26 of the Indian Companies Act, 1913,

the Indian Institute of Banking & Finance (IIBF), formerly known as The Indian

Institute of Bankers (IIB), is a professional body of Banks, Financial Institutions,

and their employees in India. The Vision and Mission statements of IIBF are:

VISION

To be the premier Institute for developing and nurturing competent professionals in banking and finance field.

MISSION

To develop professionally qualified and competent bankers and finance professionals

primarily through a process of education, training, examination, consultancy / counselling

and continuing professional development programs.

The Institute is managed by a Governing Council consisting of representatives of major Banks, Indian Banks’ Association, Institute for Development and Research in Banking Technology, Institute of Banking Personnel Selection and an academician from the Indian Institute of Technology, Bombay.

The day-to-day management of the Institute vests in the hands of the Chief Executive Officer (CEO) who in turn is supported by Director – Operations, Director – Academics and Director – Training.

Banking & Finance being a knowledge-driven industry, the role of IIBF has undoubtedly been pioneering in keeping the bankers updated and upgraded. IIBF has been a professional body of Banks, Financial Institutions and their employees in India with 11,13,715 ordinary members as on March 31, 2025.

The range of activities of the Institute are:

1. Education/Certification

Confucius, the wise Chinese philosopher, once said, “Knowledge without

practice is useless. Practice without knowledge is dangerous.”

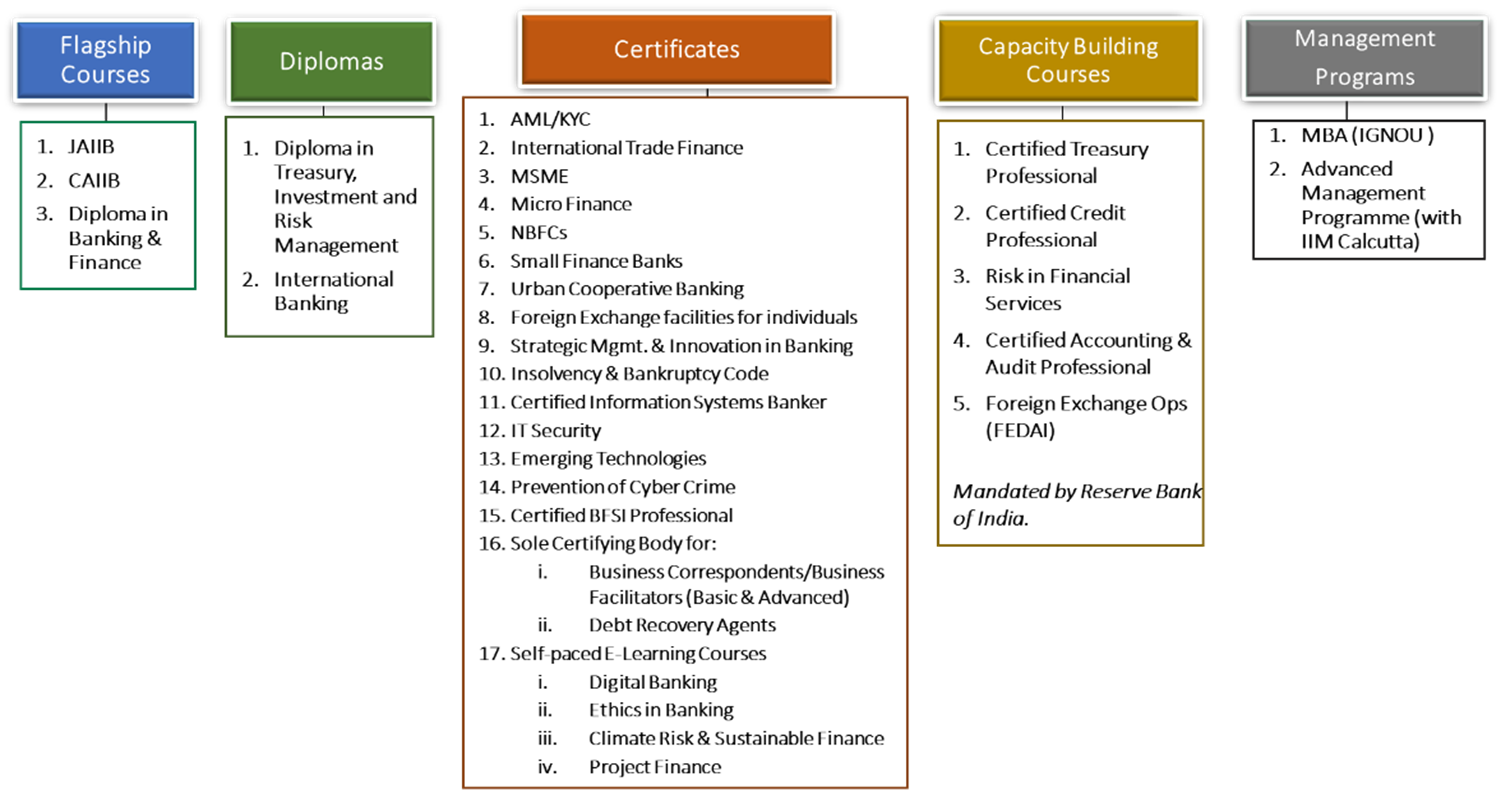

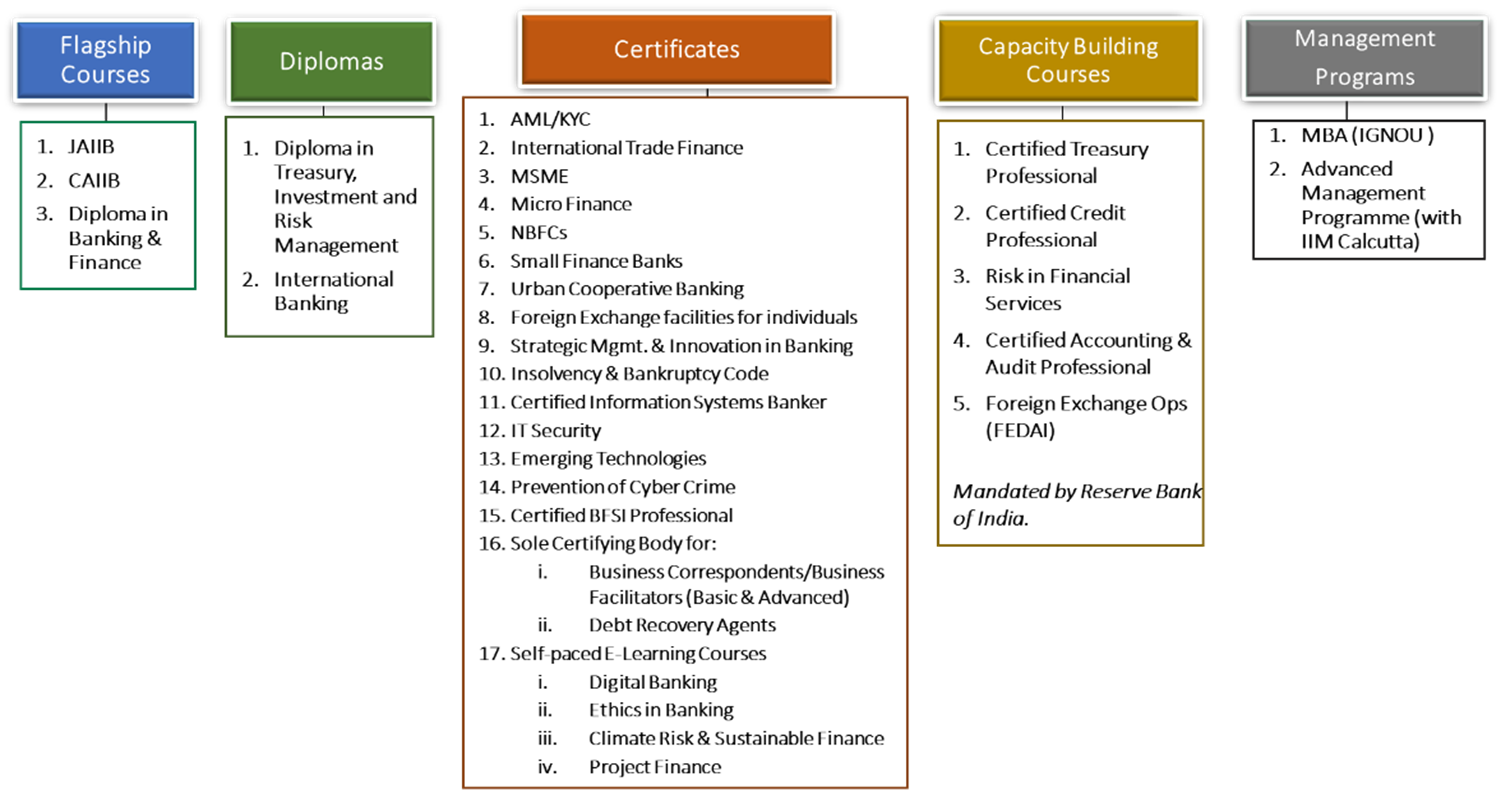

Undoubtedly, for a knowledge-oriented industry like Banking and Finance, it is an absolute necessity for a Banker to acquire, consistently build upon and update his/her knowledge base to function effectively, as per the evolving expectations of the industry. IIBF plays the significant role of being the knowledge partner for the banking fraternity. Primarily recognised as the premier education and certification body with a penchant for absolute quality in terms of content coverage & delivery, the Institute currently conducts certifications for 3 flagship courses, 2 Diploma courses, 27 Certificate courses, 6 blended courses in specialised domains and an Advanced Management Programme in collaboration with IIM-Calcutta.

The flagship courses of the Institute, namely JAIIB & CAIIB, provides the practicing

Bankers the fundamental knowledge base on Banking and still remains, till date,

the most sought-after qualification in Banking in India. The Certificate courses

provide the common denominator knowledge and also assists the practising Bankers

to constantly broaden one’s boundary of knowledge through courses like Emerging

Technologies and Strategic Management in Banking. Additionally, through its Continuing

Professional Development Programmes, IIBF encourages the Bankers to demonstrate

self-development by continuous learning, in an increasingly competitive professional

domain. The capacity building courses on specialised areas like Treasury, Credit,

Risk Management, Accounting etc. as mandated by Reserve Bank of India are delivered

in a blended mode i.e. an on-line examination and mandatory classrooms sessions

in-built, to ensure 360-degree learning. All of these courses are meticulously designed

and delivered in line with changing contours of Banking and Financial services sector.

IIBF offers specially customised courses for Banks and NBFCs. This approach leads to the development of tailored certification programmes for individual public sector banks, private sector banks and NBFCs, addressing specific learning gaps in key domains like AML-KYC, Compliance, MSME, Customer Service, Cash Management, Business Ethics, and Risk Management. Courseware is co-created in close coordination with the concerned bank's HR/L&D department, focusing on job-specific needs and incorporating internal guidelines wherever applicable.

e-Learning is fast becoming the preferred mode of learning, especially for working

professionals across the industry. The Institute has been proactive in assimilating

e-Learning in its pedagogical repertoire. The e-Learning modules developed by the

Institute have been accepted and recognised by the banking fraternity for the following

reasons:

- Simple and interactive user interface

- Wide range of subject-coverage

- Enables to learn at one’s own pace

- Content driven to impart complete knowledge

- Exercises to test learning skills

- Customisable to suit Bank’s requirements

These e-Learning modules have been made available for individual members and non-members

as well as institutional members like banks at a nominal cost, duly customised for

on-boarding of new inductees if required.

Given the pandemic-led disruptions, the Institute has been conducting certain key

examinations in the remote-proctored mode for greater reach & operational efficiency.

The Institute also happens to be the sole certifying body for Business Correspondents

(BCs) & Debt Recovery Agents (DRAs).

2. Training

Training sessions organised by IIBF provide a platform to the practising Bankers

to share their knowledge & practical experiences with industry peers and also

an opportunity to keep pace with the changes in the prevalent regulations in the

entire Banking & Financial Services sector. IIBF has been conducting both Open

and Customised Training Programmes on a regular basis, on a plethora of Banking

subjects like Treasury, Credit, Risk Management, International Trade, Retail Banking,

Compliance, Audit, Cyber Crime, etc., to name a few.

The programmes organised by the Institute have been appreciated and recognised for

the quality of content and mode of delivery, by all the participating banks and

financial institutions. The faculty members of the Institute being very accomplished

Bankers themselves, the sessions have been practical and relatable to the participating

audience and hence, have been held in high esteem for their inherent applied nature.

Some of the lectures are uploaded in the Institute’s designated portal, so

that the interested candidates may access whenever required.

IIBF, in addition to the regular training programmes, has also been conducting Leadership

Development Programmes in coordination with XLRI, Jamshedpur and Strategic Training

Programmes with JBIMS, Mumbai.

3. Research and Publications

“Research is creating new knowledge.” –

Neil Armstrong

IIBF has been promoting active research in Banking & Finance domain with the

objective of developing analytical minds with pertinent ideas, capable of positively

contributing to the overall developmental process of the industry. the Institute

offers the following research schemes to bankers/academicians to encourage them

to undertake research in the banking & finance domains:

- Macro Research

- Micro Research

- Diamond Jubilee & CH Bhabha Banking Overseas Research Fellowship

- Scheme for Research in Banking Technology (Jointly with IDRBT)

The Institute encourages peer-review and offers scholarships and monetary supports

to the deserving researchers. The research activities sponsored by IIBF have seen

encouraging responses from top B Schools and IITs.

As for publications, IIBF regularly brings out three publications, namely the IIBF Vision and Bank Quest and Banking & Finance Year Book. Bank Quest, is a Journal which is published quarterly, provides continuous professional knowledge to the bankers through publication of relevant articles by experienced professionals. IIBF vision, published monthly, documents the important changes in the Banking & Finance domain and is an effective platform for knowledge-sharing for the banking fraternity. The Banking & Finance Year Book is a comprehensive digest of all major developments, trends, expert views and regulatory changes across different verticals in Banking & Finance domain. Further, the extracts of important speeches rendered by senior officials of RBI have been included for giving the reader a wholesome reading experience.

Besides the above, IIBF has been curating & publishing its own books for all

of its Academic programmes. These books have been appreciated by the industry for

their depth in coverage, while maintaining a rather lucid authoring interface. Needless

to say, these books are authored by very experienced Bankers/Academicians to ensure

quality and updated content.

4. Seminars/Memorial Lectures

IIBF also conducts Memorial Lectures/Seminars/Webinars on contemporary topics for

the benefit of the banking fraternity. The two prestigious Memorial Lectures

being conducted by IIBF are the Shri R K Talwar Memorial Lecture and the Sir Purshotamdas

Thakurdas Memorial Lecture. Several well-known luminaries have delivered these Lectures

over the years. As in 2025, Shri M. Nagaraju, Secretary, Department of Financial Services, Ministry of Finance has delivered the Shri R. K. Talwar Memorial Lecture and Prof. (Dr.) Manoj Kumar Tiwari, Director, IIM Mumbai, graced the podium for Sir Purshotamdas Thakurdas Memorial Lecture (PTML).

5. Consultancy

The Institute regularly extends its consultancy services to Institutes/Organisations located in foreign countries in the area of capacity building in Banking & Finance. Consultancy assignments were undertaken by IIBF for banks/training institutions located in Tanzania, Zambia, Papua New Guinea, Nepal, Bhutan, Botswana, etc.

National Collaborations

IIBF, for certain courses, has entered into collaborations with well recognised

organisations, keeping in mind the constant need to add academic and professional

value to the participants. The key national collaborations are tabulated as below:

Global Footprints

a) Founder Member of GBEStB

At one of the World Congress of Banking Institutes held in Lagos, Nigeria, Banking

Institutes representing around 25 countries, launched the Global Banking Education

Standards Board (GBEStB). The GBEStB which is a voluntary, industry-led initiative,

aims to develop clear, internationally agreed standards for the education of Professional

Bankers. IIBF is one of the founder members of GBEStB.

b) Collaboration with Chartered Banker Institute, UK

The Institute has entered into a Mutual Recognition Agreement (MRA) with the Chartered

Banker Institute, U K, offering a pathway for the Junior Associate of Indian Institute

of Bankers (JAIIB) and Certified Associates of the Indian Institute of Bankers

(CAIIB) from India, to have their qualifications recognised by the Chartered Banker

Institute and be able to become Chartered Bankers.

c) Collaboration with Chartered Institute for Securities & Investment, London

IIBF has collaborated with Chartered Institute for Securities & Investment,

London for IIBF’s course on Certificate in Risk in Financial Services (CRFS).

The candidates who have cleared the CRFS examination conducted by the Institute

are eligible to apply for CISI’s Level II examination.

d) Collaboration with GARP

IIBF entered into a collaboration with GARP (Global Association of Risk Professionals)

to offer the FRR course, aimed at benefitting the risk professionals with respect

to the current challenges faced and opportunities available for the bankers.

e)FPSB

IIBF entered into a collaboration with Financial Planning Standards Board Ltd.- India to offer the fast track pathway for Certified Financial Planner certification program.

Professional Banker Programme

In order to meet the twin objectives of bridging the skill gaps and having a system

of continuous professional development, a gold level aspirational qualification

called “Professional Banker” has been introduced by the Institute.The

“Professional Banker” programme has been designed carefully based on

series of discussions with the top management of banks. The concept is based on

the job family being adopted by various banks. This will open an opportunity to

the bankers to attain specialisation in any of the tracks and will prove beneficial

for the organisation too.The path to being a professional banker is diagrammatically

indicated below:

Advanced Management Programme with IIM-Calcutta

IIBF conducts Advanced Management Programme (AMP), a management course for working

Officers and Executives from the Banking / Financial Sector in collaboration with

IIM-Calcutta. The programme covers the entire spectrum of Banking / Financial Management

subjects and aims at upskilling the Future Leaders in the Banking and Finance domain.

The candidates for the Programme are either sponsored by the participating Banks/Financial

Institutions or are self-sponsored.

Concluding Remarks

Henry Ford, the visionary industrialist, once famously remarked,

“Anyone who stops learning is old, whether at twenty or eighty. Anyone

who keeps learning stays young.”

In that same spirit of consistent growth through quality education, IIBF has always

endeavoured to maintain a quality benchmark for all the Bankers of the nation to

achieve, so that the entire sector may live up to the changing expectations of the

times. IIBF has truly been the pioneer in banking education in India.

The Financial sector in India is in a constant state of flux, with ground-breaking

new technologies ushering in a paradigm shift. Knowledge, as always, is widely acknowledged

to be the proverbial silver-bullet. At this juncture, as the Institute closes in

to a well-deserved ‘Century’ in the service of the banking fraternity,

IIBF is already in the process of re-discovering itself as a new-age academic organization

with redesigned academic programmes and cutting-edge pedagogical tools, in an endeavour

to offer a wholesome learning experience to the Banking fraternity and to stay by

the side of the Bankers as the ever-trusted learning partner, as they move forward

in their professional career.

e-Learning

e-Learning

Apply Now

Login

Apply Now

Login