Dear Member,

This forum presents me an opportunity of sharing with you the important developments

of the Institute which have happened in the recent past. Before I do so, let me

again start with a quote.

There is no end to education. It is not that you read a book, pass an examination,

and finish with education. The whole of life, from the moment you are born to the

moment you die, is a process of learning.

Jiddu Krishnamurti.

Foundation Day

Your Institute celebrated its 91st year on 25th April 2019.

At this occasion, Dr. D Udaya Kumar, Associate Professor & Head of Department

of Design, IIT, Guwahati, who created the Indian Rupee Symbol, spoke eloquently

on the process followed by him for designing this symbol. His session was truly

enriching. Besides this, the convocation of the VII batch of the Advanced Management

Program (AMP) also took place.

Advanced Management Program - VIII batch

Your Institute, as a part of its varied offerings, also conducts an Advanced Management

Programme (AMP). The AMP, which is meant for developing and nurturing future leaders

of the industry, is an eight-month program having classes on Sundays and bank holidays.

One of the USPs of this course is an in-built immersion programme on General Management

by IIM Calcutta. While the concepts underpinning general management are taught by

professors of IIM(C), the intricacies involved in the banking and finance domains

are covered by IIBF. Hence, the candidates taking up this course gain an in-depth

subject knowledge from two institutions well known and respected in their respective

fields.

The lectures for the AMP are conducted at IIBF's Leadership Centre at Kurla, Mumbai

and are held on weekends / Bank Holidays.

The VIII batch of the Advanced Management Program is scheduled to commence from

July 2019. As the seats for the AMP are limited, I would urge upon the members

to avail of this opportunity and enrol for the course at your earliest convenience.

Ethics in Banking

Today, ethics and corporate governance are the cornerstones, as they epitomise the

values of an organisation. Most of the renowned institutions both nationally and

internationally have ethics as a part of their curriculum. Recognising the importance,

I am happy to share with you, IIBF has introduced a separate course on “Ethics

in Banking.”

The principles of Ethics in Banking are envisioned to be applied by bankers for

ensuring sustainability of the existing reputation and reliability of the banking

profession to the public and to protect and maintain stability, consistency and

confidence in the banking sector.

As ethical principles need to be followed by all the staff in an organisation, it

was felt imperative by the Institute that knowledge on certain fundamental aspects

of “Ethics in Banking” is disseminated to a larger population of bankers

at different levels. It has therefore been decided, that apart from a separate certificate

course on “Ethics in Banking”, certain units from the courseware on

the subject, are made part of the first paper of JAIIB namely “Principles

and Practices of Banking.” The examination on this subject held in May 2019

had some questions on “Ethics in Banking.”

Self-paced e-learning courses

Presently, all the examinations conducted by the Institute are proctored. Recognizing

the emerging requirements of Gen Y/Z, IIBF has now taken the initiative of developing

self-paced e-learning courses. Two courses namely “Ethics in Banking”

and “Digital Banking” have been taken up in the first phase.

Development of self-paced e-learning is an attempt by IIBF to provide a more conducive

learning environment to professionals employed in the banking and finance sectors.

Under this approach, which harnesses technology to an optimal extent, a candidate

will have the flexibility to register for the exam, learn at his / her own pace,

and finally take an examination from his / her own place.

In the short time since its launch, the responses to the two courses have been heartening.

Case Study Writing Competition

A case study is an important pedagogical tool for enhancing learning and comprehension

of complex and multi-fold situations. IIBF has taken the initiative of organising

a case study writing competition to encourage bankers/finance professionals to share

their knowledge and experience through developing cases, accompanied by Teaching

Notes. The aim of this competition is to encourage bankers to simulate an academic

environment and develop case studies relevant to the banking & finance domains.

I would request members to participate in the competition, share their rich experiences

and also win attractive prizes. Details of the scheme are placed on the website

Collaboration with Chartered Banker Institute

The Chartered Banker Institute, UK and The Indian Institute of Banking & Finance

(IIBF) have signed a Mutual Recognition Agreement.

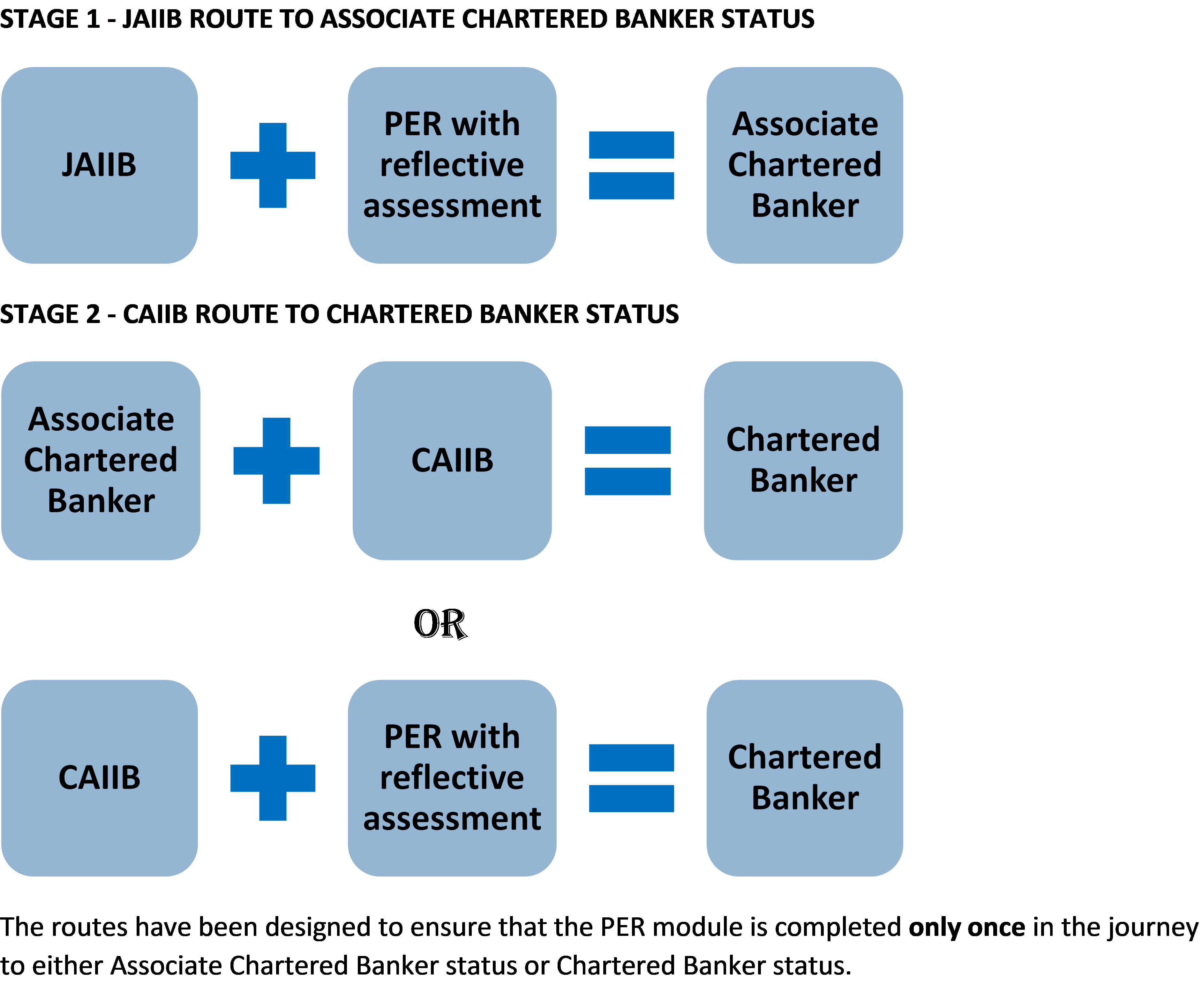

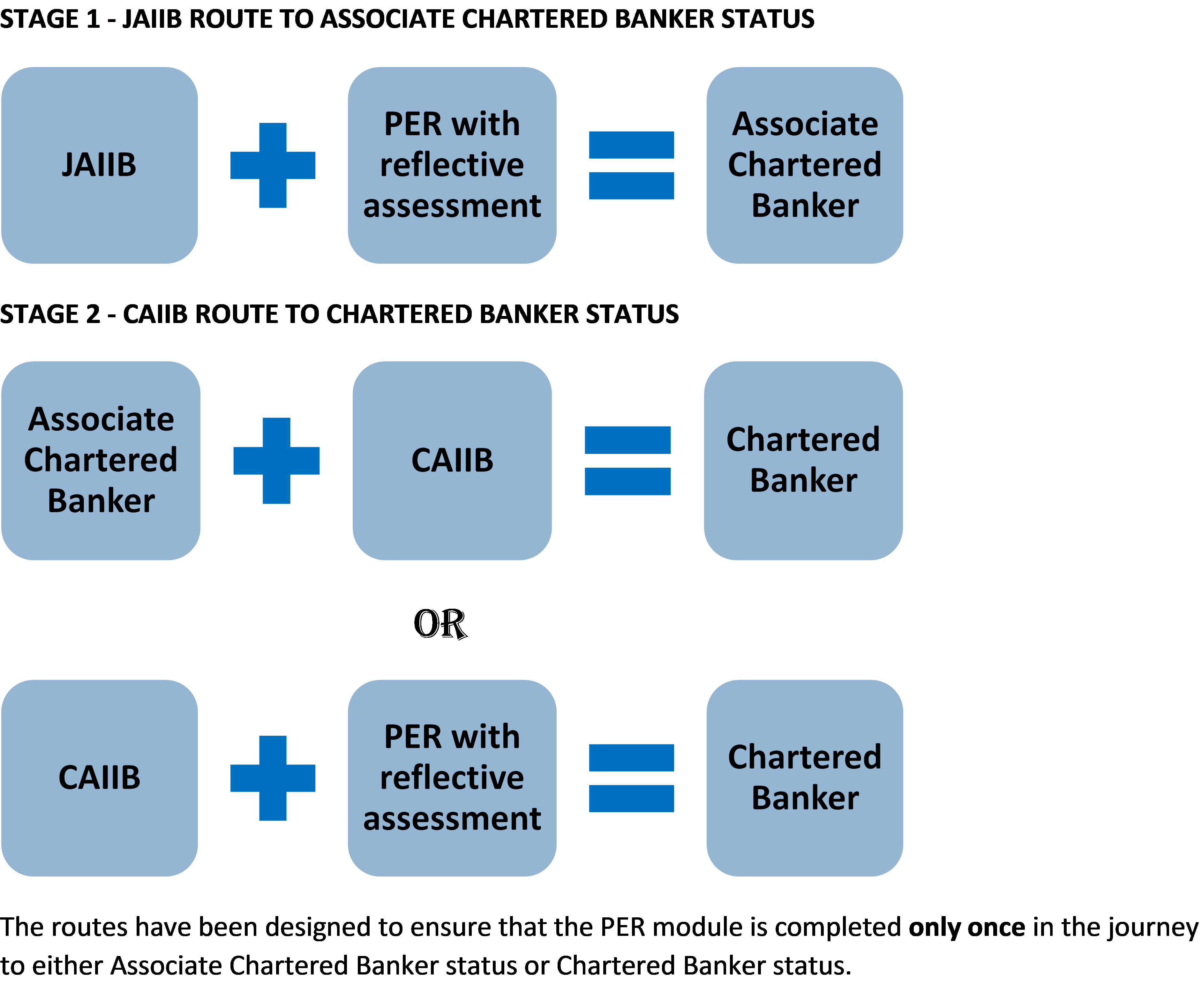

Under this agreement, “Certified Associates of the Indian Institute of Bankers”

(CAIIB) from India will have their qualifications recognised by the Chartered Banker

Institute, UK and will be able to become Chartered Bankers by studying the Institute’s

Professionalism, Ethics & Regulation module (PER), and successfully completing

a reflective assignment.

Apart from the above development, the JAIIB holders, once they complete the PER

module, will be called as Associate Chartered Banker and after they acquire the

CAIIB qualification, will become a Chartered Banker. For the PER module, the courseware

published by IIBF on “Ethics in Banking” will be the study / reference

material with the reflective assessment being done by the Chartered Banker Institute.

The modalities in this regard are being worked out and the details will be placed

on our website shortly.

Enrolments for different exams

More than 5 lakh candidates enrolled for the various exams of the Institute in 2018-19

presumably due to the value additions offered. The exams are normally conducted

at half yearly intervals, although some of the courses are now available at increased

frequencies.

Meeting of the Heads of HR/Training of Banks

The meeting of the Heads of HR/Training of Banks was held at the Corporate office

of IIBF on 13th February 2019. The participants were briefed by IIBF

about its various activities. This meet helps the Institute in understanding the

requirements of the bankers which culminate in developing new courses.

As a part of this meet, an interactive integrity session was also organised by the

Institute in association with CISI, London. Mr. Kevin Moore, Director, CISI, London

took the session and walked the participants through case studies involving ethical

behaviour.

Examination for Business Correspondents

I am happy to announce that the RBI has mandated the examination for the BCs offered

by IIBF to be taken by all the BCs. The course offered by the Institute will

be the basic certificate course for the BCs.

Virtual Classroom Solution

The Institute has acquired a software for conducting training through the Virtual

Classroom mode. This enables the Institute to disseminate the training inputs to

a larger audience without diluting quality. The trainings for Certified Credit Professionals,

Certificate in Risk in Financial Services, Certified Treasury Professional and Certified

Accounting & Audit Professional are currently being offered in this mode. Kindly

visit our website for more details.

Capacity Building

IIBF is the only Institute which has courses identified by RBI under the capacity

building efforts of the banks, namely Credit Management, Risk Management, Treasury

Management, Accounting & Audit and Foreign Exchange Operations. For the

courses on Credit, Treasury, Risk and Accounting & Audit, the Institute is also

imparting training through its virtual classroom mode (VCRT) apart from the physical

class room mode. The VCRT mode of training, which simulates the physical mode of

training, has enabled the Institute to improve its outreach without diluting its

quality. The training under VCRT mode for the capacity building courses are

offered free of charge and the Institute absorbs the entire cost of training.

I am happy to note that the Institute has witnessed good enrolments for all the

above courses.

Mock Test facility for Examinations

The Institute is offering mock test facility for three of the capacity building

courses, namely, Certified Treasury Professional, Certified Credit Professional

and Risk in Financial Services, in addition to its flagship courses viz. JAIIB &

CAIIB. Any candidate can now take the mock test to familiarize with the examinations.

E- learning

The Institute is providing e-learning for JAIIB, CAIIB, DB&F, Diploma in Treasury,

Investment & Risk Management, Customer Service & Banking Codes & Standards,

Anti-Money Laundering/Know Your Customer and Risk in Financial Services Examinations.

The e-learning for the above subjects are activated within three working days after

registration for the above-mentioned examinations.

Video Lectures now available on YouTube

The Institute is providing the facility of video lectures for all the 3 papers of

JAIIB and 2 compulsory papers of CAIIB, which are now available on the Institute's

official YouTube Channel. For the convenience of the candidates, new video lectures

containing the updates for the JAIIB & CAIIB (two compulsory subjects only)

have also been made available on the Institute’s official YouTube page in

a separate Playlist.

Video lectures, in English and Hindi, covering the BC certification have been recorded

and have been placed on the You Tube page of the Institute.

Training

The Institute, apart from conducting training under the capacity building courses,

also conducts training programmes in other niche areas. Trainings on “Insolvency

and Bankruptcy Code 2016”, "IT & Cyber Security” were conducted

recently in addition to other programmes.

Considering the requirements of the industry, the Institute also introduced new

training programmes during the year. A three-day programme for Internal Auditors

of the Banks and a programme for Law officers of banks and Financial Institutions

were also launched for specialised group of officials,

Bank Quest

The Institute publishes a quarterly journal called “Bank Quest”.

The themes for next issues of “Bank Quest” are identified as:

- Ethics & Corporate Governance in Banks: April - June, 2019

- Emerging technological changes in Banking: July - September, 2019

I request members to contribute articles on the above themes for publication in

“Bank Quest”.

Updation of course wares

Institute has updated all the CAIIB compulsory and elective subjects and also revised/updated

the courseware on Inclusive Banking through BCs in 9 languages.

Social Media

The Institute is on Facebook and You Tube. The page has since got over 1,00,000

likes on various types of posts viz. IIBF / RBI notifications, Quote of the day,

Opinion Poll, Greetings, Photos and videos of various events / seminars / conferences

conducted by the Institute. Besides, there were over 200,000 views on the Institute’s

YouTube page.

Green Initiative

As part of green initiative, the Institute has discontinued sending hard copies

of its monthly publication “IIBF Vision” with effect from October-2015

to its members. In case, you have not registered your e-mail id with the Institute,

I request you to do so to enable the Institute to send copies of IIBF Vision by

e-mail to you in future. You can also download issues of “IIBF Vision”

and “Bank Quest” from the Institute’s website.

We, at the Institute are thankful to all of you for your continued support. I am

also sure your unstinted cooperation will continue in the years to come.

I welcome suggestions and guidance from the members on various academic and training

activities of the Institute.

Dr. J. N. Misra

9th May 2019

e-Learning

e-Learning

Apply Now

Login

Apply Now

Login